Retirees Need These Two Things To Boost Their Odds of Success

Plenty of retirees think the biggest risk to their money is a stock market crash. Others fear inflation. But I believe the biggest enemy faces them in the mirror.

Here’s a shocking example: Fidelity Investments reported that almost one-third of the firm’s investors over the age of 65 sold all of their stock market investments between February 20 th and May 15 th , 2020. In other words, they panicked during COVID-19s stock market plunge.

Unfortunately, knee-jerk reactions cost investors plenty. Stocks often crash. But, as difficult as that is, retirees should ignore market movements and predictions.

Back-tested studies suggest that retirees with a diversified portfolio should be able to withdraw an inflation adjusted 4 percent per year. The money should last at least 30 years…if human behavior doesn’t mess it up.

To give this strategy the best odds of success, retirees need two things:

Nerves of steel

A diversified portfolio of low-cost index funds

Source: Wall Street Journal, Fidelity Investments

Unfortunately, few people talk about the much-needed nerve.

First, let me explain how the 4 percent rule works. If a couple retired with $100,000, they could withdraw $4000 during their first year of retirement. That’s 4 percent of $100,000. The following year, they would check the previous year’s inflation rate. If the cost of living increased by 2 percent, they would withdraw 2 percent more than $4000 during the second year of retirement. Each year, they would withdraw an ever-increasing amount to cover the rising cost of living (unless a period of deflation resulted in withdrawing less).

This all sounds peachy. But without nerves of steel, plenty of people fail. Consider the last 20 years. Anyone retiring in 2000 would have faced three frightening market crashes. It would have been one of the worst times in history to retire. From January 1, 2000, to September 30, 2002, U.S. stocks plunged 47 percent. From January 2008 to February 28, 2009, U.S. stocks cratered almost 49 percent. And from February 1, 2020, to March 31, 2020, American stocks dropped about 33 percent.

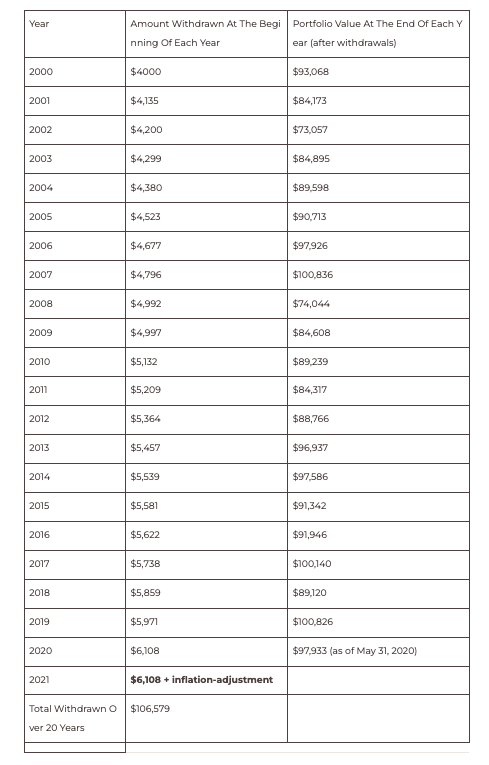

Assume a retiree had the nerve to stay the course. They would have retired with a $100,000 portfolio in January 2000. They then could have withdrawn an inflation-adjusted 4 percent per year for 20 years (2000-2020). If they stuck to their plan, they could have withdrawn a total of $106,579 from their initial $100,000 portfolio…and they would still have money left.

According to portfoliovisualizer.com, despite these withdrawals, the investor would have had $97,933 remaining by May 31, 2020.

You might wonder, however, if this $97,933 could last another 10 years. After all, the investor would need to withdraw more than $6,108 at the beginning of 2021. I base this assessment on the 4 percent inflation adjusted withdrawals, which you can see on the table below.

4% Inflation Adjusted Annual Withdrawals For $100,000 Portfolio

January 2000 – January 2020

Source: portfoliovisualizer.com

We don’t know if the remaining money would last another ten years. But Vanguard’s Monte-Carlo calculator determines the odds are high. It assumes anything that happened in the past could happen again. Stocks could fall 86 percent, as they did from 1929 to their trough in 1932. That market drop wasn’t coupled with inflation. But what if inflation ran high while such a drop occurred?

The Monte-Carlo simulator tosses 100,000 historical variables into the mix.

Based on Vanguard’s calculations, the $97,933 that still remained after 20 years would have a 99 percent chance of lasting another 10 years; an 86 percent chance of lasting another 15 years; and a 65 percent chance of lasting another 20 years.

Unfortunately, plenty of retirees will sabotage their rides. It’s easy to say, “The 4 percent rule works.” But it’s also worth asking: How many people have the mettle?

Andrew Hallam is a Digital Nomad. He’s the author of the bestseller Millionaire Teacher and Millionaire Expat: How To Build Wealth Living Overseas

This article and or podcast contains the opinions of the author but not necessarily the opinions of AssetBuilder Inc. The opinion of the author is subject to change without notice. All materials presented are compiled from sources believed to be reliable and current, but accuracy cannot be guaranteed. This article is distributed for educational purposes, and it is not to be construed as an offer, solicitation, recommendation, or endorsement of any particular security, product, or service.

Performance data shown represents past performance. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown.

AssetBuilder Inc. is an investment advisor registered with the Securities and Exchange Commission. Consider the investment objectives, risks, and expenses carefully before investing.