November 8, 2018

Written By: Andrew Hallam

Nathalie Legrée is a great saver. Motivated by the FIRE movement, she wants to gain Financial Independence and Retire Early. The 33-year-old teacher joins a growing number of millennials that have decided to live frugally and sock away large percentages of their incomes every year. Nathalie already owns a couple of houses. She also has $60,000 invested in portfolio of low-cost index funds. Currently she’s investing about $2000 a month.

But the recent market crash has tossed water on her flames. “I started to invest in a portfolio of ETFs about a year and a half ago,” she says. “But the market’s drop has me wondering if I’ve made the right decision. It has me thinking that perhaps I should invest in real estate instead.”

She isn’t alone. Tim Van Vliet is a 34-year-old pilot who aims to be financially independent in about 10 years. “I heard about this FIRE movement over the last couple of years,” he says. “But now, with the stock market drop, my wife and I are feeling a bit uneasy to see our portfolio value drop.”

Like many new investors, Nathalie and Tim have never experienced a stock market drop. U.S. stocks rose every year from 2009 to 2017. That’s an all-time record, calendar year streak. The S&P 500 averaged a compound annual return of 15.11 percent over that nine-year period.

But the recent stock market’s drop might help Nathalie’s and Tim’s early retirement goals, if they can harness their emotions.

William Bernstein, the former neurologist turned financial advisor, says young investors should “pray for a long, awful [down] market.” In his book, If You Can, he says that when stocks drop, investors pay less money for a greater number of shares. When people invest consistent sums every month (dollar cost averaging) they can stockpile assets when they’re cheap. When the markets recover, those asset values soar.

Warren Buffett says much the same thing in his 1997 letter to Berkshire Hathaway shareholders:

“If you will be a net saver over the next five years, should you hope for a higher or lower stock market during that time period? Many investors get this one wrong. Even though they are going to be net buyers of stocks for many years to come, they are elated when stock prices rise and depressed when they fall…This reaction makes no sense. Only those who will be sellers of equities [stock market investments] in the near future should be happy at seeing stocks rise. Prospective purchasers should much prefer sinking prices.”

I gave Nathalie two scenarios, asking which she might prefer.

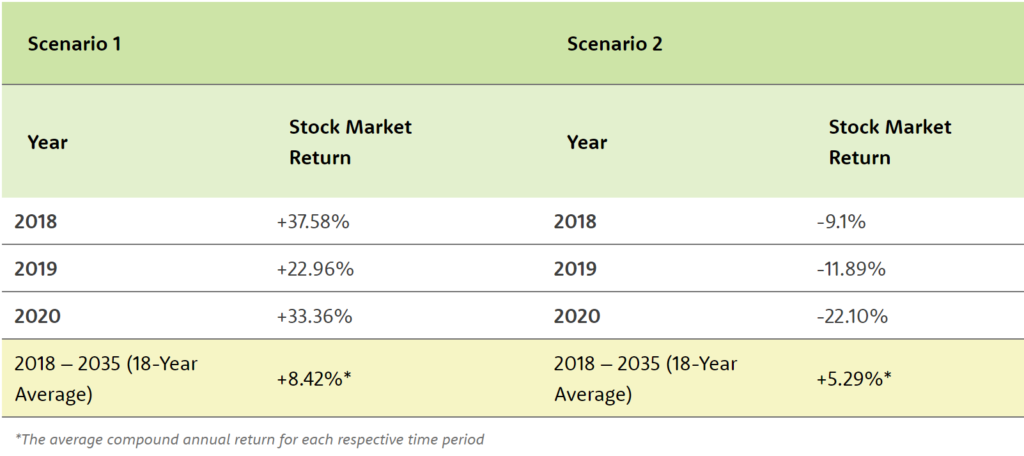

In Scenario 1, the stock market soars for three straight years. Over 18 years, it gains a compound annual return of 8.42 percent.

In Scenario 2, the stock market slumps for three straight years. Over 18 years, it gains a compound annual return of 5.29 percent.

A Tale of Two Scenarios

Nathalie says, “I would absolutely prefer Scenario 1. Seeing your stocks rise on a yearly basis is always more reassuring. Those look like strong numbers that promote trust in the market.”

But Scenario 2 might make her more money, despite starting off with three bad years and recording a lower 18-year compound annual return. After all, if a young investor adds money every month, that will buy a greater number of units when the market drops. This could boost Nathalie’s long-term return when stocks recover.

I didn’t pull these scenarios out of a hat. Each represents different historical 18-year returns for the S&P 500.

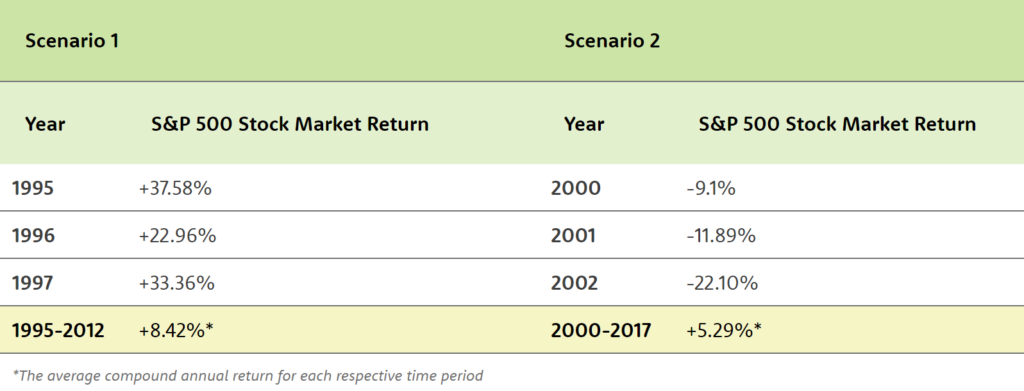

Scenario 1 shows the returns from January 1, 1995 to December 31, 2012. Stocks soared in 1995, 1996 and 1997, gaining 37.58 percent, 22.96 percent and 33.36 percent respectively. A lump sum investment in the S&P 500 would have earned a compound annual return of 8.42 percent over this 18-year time period.

Scenario 2 represents the actual returns of the S&P 500 from January 1, 2000 to December 31, 2017. Stocks dropped right out of the gate, losing 9.1 percent in 2000, losing 11.89 percent in 2001 and losing 22.10 percent in 2002. A lump sum investment in the S&P 500 would have earned a compound annual return of just 5.29 percent over this 18-year duration.

Actual Returns of the S&P 500

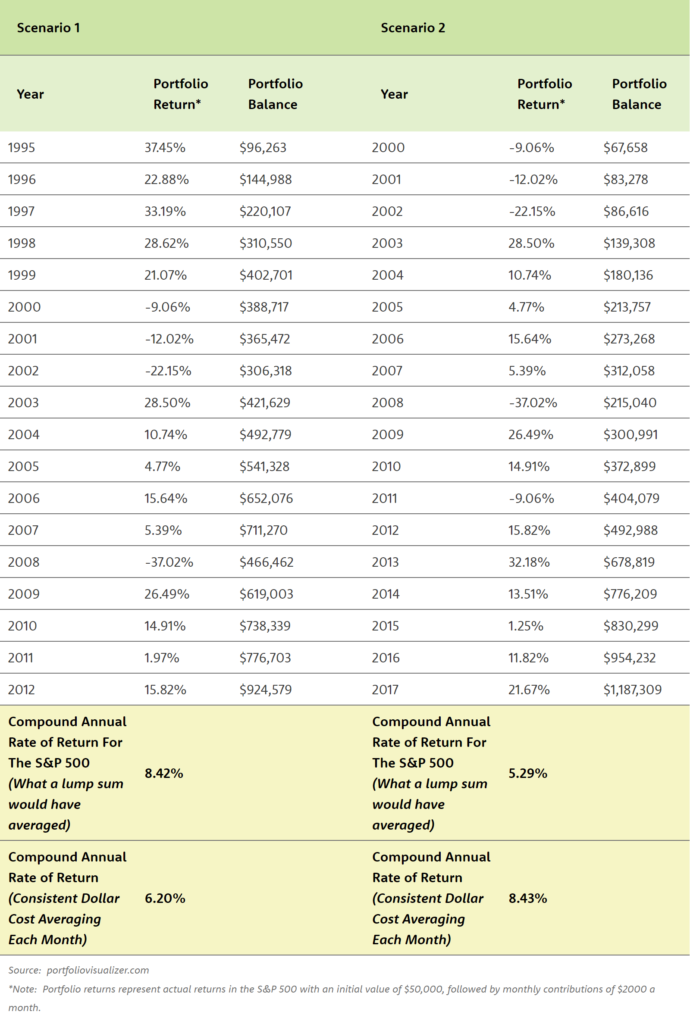

Let’s start with Scenario 1.

Assume Nathalie had $50,000 in a portfolio of low-cost index funds in January 1995. If she had invested an additional $2000 a month into the S&P 500 from January 1995 until December 2012, her money would have grown to $924,579.

Now let’s look at Scenario 2

Assume Nathalie had $50,000 in a portfolio of low-cost index funds in January 2000. If she had added $2000 into the S&P 500 from January 2000 until December 2017, her money would have grown to $1,187,309. That’s a whopping difference of $262,730 over what she would have earned in Scenario 1.

In other words, experiencing three huge calendar year losses, early in her investment journey, would have boosted her annual return. She would have earned a compound annual return of 8.43 percent per year, despite the fact that the market averaged a compound annual return of just 5.29 percent over that same time period.

Unfortunately, plenty of investors lose faith when they see poor returns. They don’t dollar-cost average through good and bad markets. Instead, they let greed and fear dictate their decisions.

But young investors, like Nathalie and Tim, should hope for falling markets. If they conquer their emotions, it might accelerate their FIRE.

Scenario 1 and 2

$50,000 Starting Value

$2000 Per Month Invested In Vanguard’s S&P 500

Andrew Hallam is a Digital Nomad. He’s the author of the bestseller Millionaire Teacher and Millionaire Expat: How To Build Wealth Living Overseas

This article and or podcast contains the opinions of the author but not necessarily the opinions of AssetBuilder Inc. The opinion of the author is subject to change without notice. All materials presented are compiled from sources believed to be reliable and current, but accuracy cannot be guaranteed. This article is distributed for educational purposes, and it is not to be construed as an offer, solicitation, recommendation, or endorsement of any particular security, product, or service.

Performance data shown represents past performance. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown.

AssetBuilder Inc. is an investment advisor registered with the Securities and Exchange Commission. Consider the investment objectives, risks, and expenses carefully before investing.